AAA game makers can't afford to ignore China anymore

We look at China’s shares of players for the biggest AAA games of the 2020s, give an overview of China’s regulatory landscape, and offer tips on how Western studios can enter the Chinese market.

Making games is bloody difficult. There’s more competition than ever, and the number of PC and console players in the West has been mostly static for a while.

But there is a market that still has plenty of growth potential when it comes to its total addressable market for PC and console games: China.

If you’re a game publisher or developer, you (and your data analysts) can’t afford to ignore China.

We’re happy to say that we have data on every major market – China included. Let’s take a look.

China is already a big part of the AAA games audience on Steam

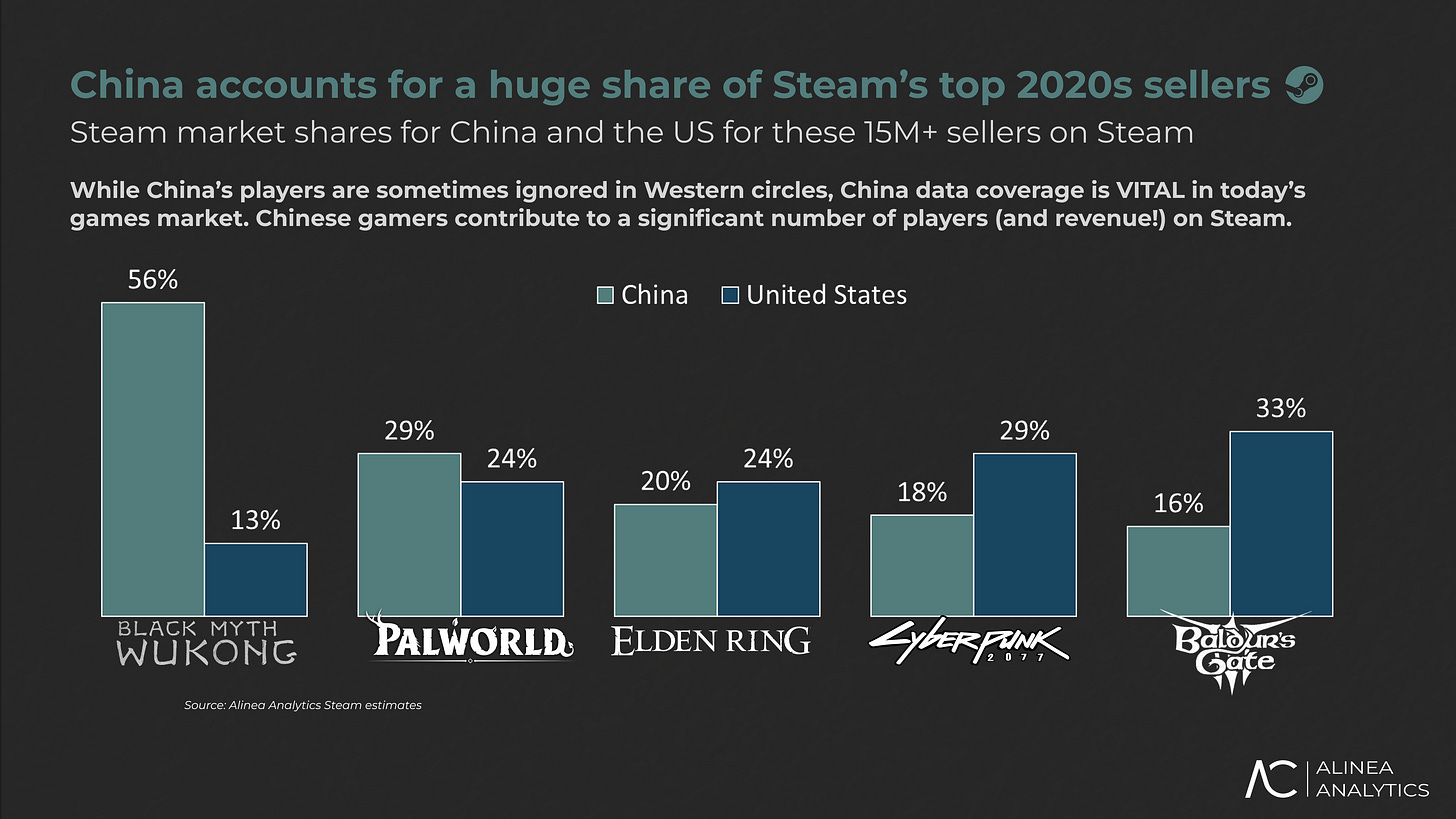

China accounts for massive shares of the audiences of the biggest AAA and single-player games of the 2020s, as per our estimates (which include all markets). Take these 15M+ sellers on Steam, for example:

As you can see, the majority of Black Myth Wukong players are in China (56%), which makes sense. The game is developed by a Chinese team and focuses on a traditional Chinese story (the novel Journey to the West).

Yet, China’s players also make up vast shares of Steam’s Western- and Japanese-developed 15M+ sellers from the 2020s – Palworld, Elden Ring, Cyberpunk 2077, and even Baldur’s Gate III.

I showed a similar chart at an event I presented at earlier this year, and I got some pushback. ‘’Apart from Black Myth, Chinese players only buy cheap and older AAA games,’’ said an attendee.

The above is a common argument, but it’s a little dated.

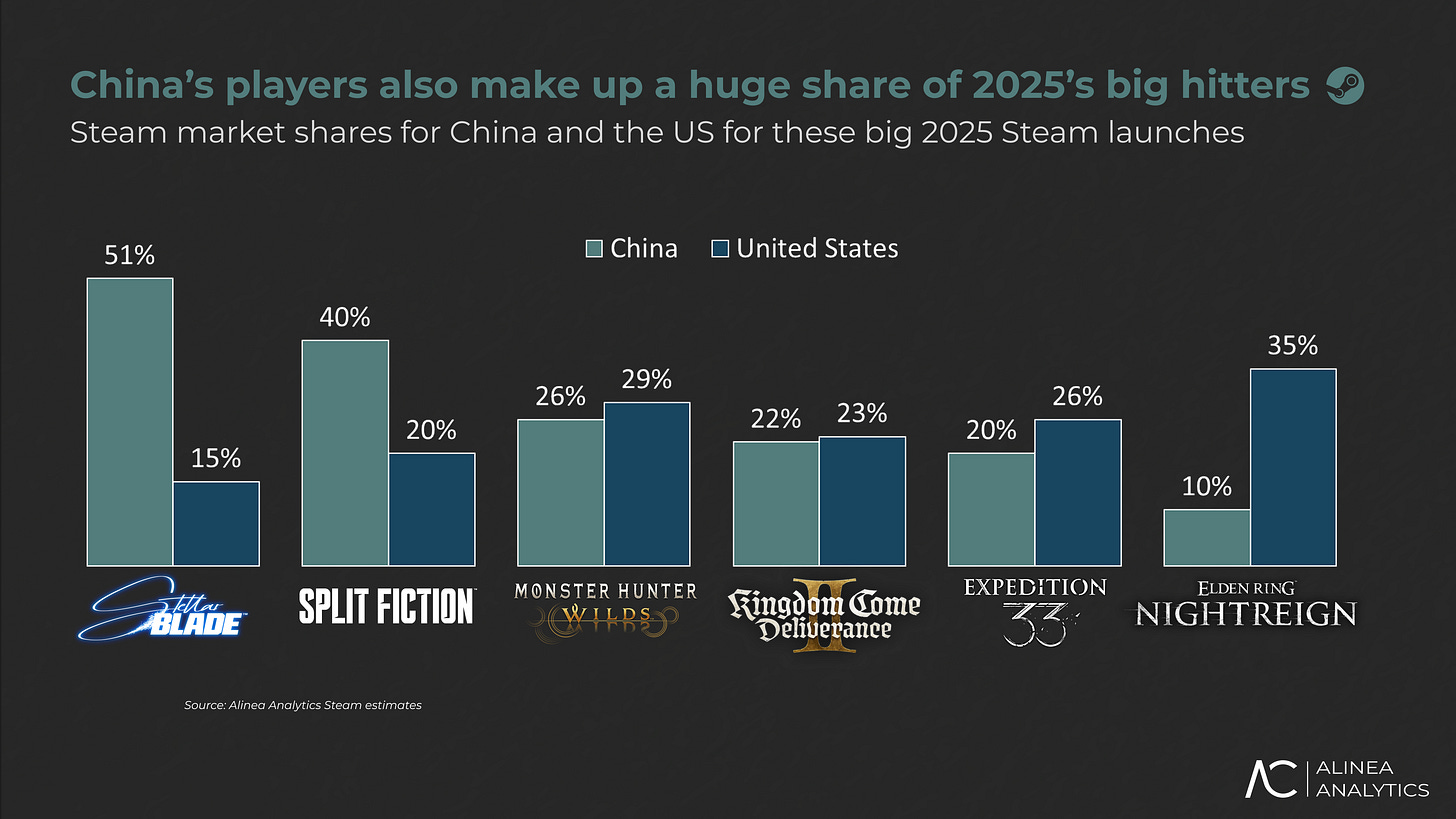

Here’s that same data for this year’s top-selling AA(A) games on Steam. Most of these have not seen discounts – and if they have, they’ve been minor:

We can still see that China accounts for far more of Steam’s Stellar Blade and Split Fiction players than other markets, and is almost on par with the US audience for titles like Monster Hunter and Kingdom Come Deliverance II.

And Kepler’s awesome Clair Obscur Expedition 33 was widely praised for its breakout-hit numbers a few months ago, but hardly anybody talked about how much China has contributed to its impressive milestones (20% of the Steam audience).

Want to see our data on China for yourself? Reach out here for a demo and trial of our platform.

China can be a tough nut to crack for Western developers, due to its uncertain and ever-changing regulatory environment. Let’s zoom in.

China has many regulations and restrictions on games

As the Chinese games market is heavily regulated by the Chinese government, many gamers there play via the grey market.

China-based players access the international version of Steam via VPNs, often setting their account country to a non-China one (typically Hong Kong). And players do something similar on PlayStation.

But China might attempt to crack down on this kind of thing in the future, so it’s worth getting up to speed with the local policies.

Here’s the need to know on the current regulations:

License-driven market access: Any game officially released in mainland China has to get an ISBN license approved via the National Press and Publication Administration (NPPA). Historically, international publishers can’t secure a license alone. They need to partner with a local holder to submit for approval. This can cause roadblocks when it comes to release timing, localisation scope and even design direction.

Approval is now more streamlined (even for international games) but remains unpredictable: After 2021’s licensing freezes and strict enforcement, approvals gain momentum again in 2023-24 and even more so this year. In fact, Split Fiction, Astro Bot, and Dave the Diver were just approved. Still, timing can be unpredictable, adding risks of queueing risk and calendar drift. This can really mess up live-ops schedules and synchronised global launches.

Youth-protection and anti-addiction controls are baked in: The government enforces account real-name systems, strict under-18 play windows, and technical anti-addiction measures. Proposals to curb certain monetisation mechanics (e.g., daily login/gacha incentives) also crop up. Even when pulled back, the proposals signal a regulatory appetite to stop residents spending too much time and money on games.

Content and cultural value review: The authorities expect games to conform to “correct values” of the Chinese government when it comes to representing violence, sex, LGBTQI+ representation, and ideals popular in the West. For approval, content can require editing and censoring.

While things have been improving, foreign devs have historically faced long approval times, tight quotas, and stricter content checks in China. In 2024, under 10% of the officially approved games were international.

A new pilot scheme might be a bright sign for the future

Promisingly, Shanghai implemented a new three-year pilot policy in July, treating games developed locally by foreign studios as “domestic” for licensing purposes.

The new three-year pilot lowers barriers, allowing faster ISBN approvals and reducing dependency on grey-area Steam access.

This is an immediate licensing advantage for international studios already operating in Shanghai, such as EA and 2K.

And for newcomers, the incentive is clear: set up local teams, integrate development pipelines into Shanghai, and leverage domestic-equivalent status for official Chinese storefronts.

Shanghai’s policy – while just a pilot – is the most encouraging development in years and might extend nationwide. But an opening up of the official Chinese games market might signal an imminent crackdown on the grey markets.

We’ll have to see.

What works right now: Marketing and go-to-market best practices

Localisation > translation: Chinese audiences expect natural dialogue, cultural idioms, and UI/UX patterns that match local norms (like short copy) – not just direct translations.

I often use Stellar Blade as an example of a Chinese launch done right. Although it was never officially released in China, Shift Up maximised its chances in the market with:

Full lip-synced dubs tailored specifically for Chinese players (not even included in the PS5 edition) – an effective way to build goodwill and positive PR.

Localised pricing at ¥268 (around $37), significantly lower than the $60 US price, making the game far more accessible to everyday consumers.

Targeted marketing in China, both online and offline, with messaging carefully curated for local audiences. Platforms like Bilibili amplified the buzz, helping spread awareness of the game’s arrival on Steam.

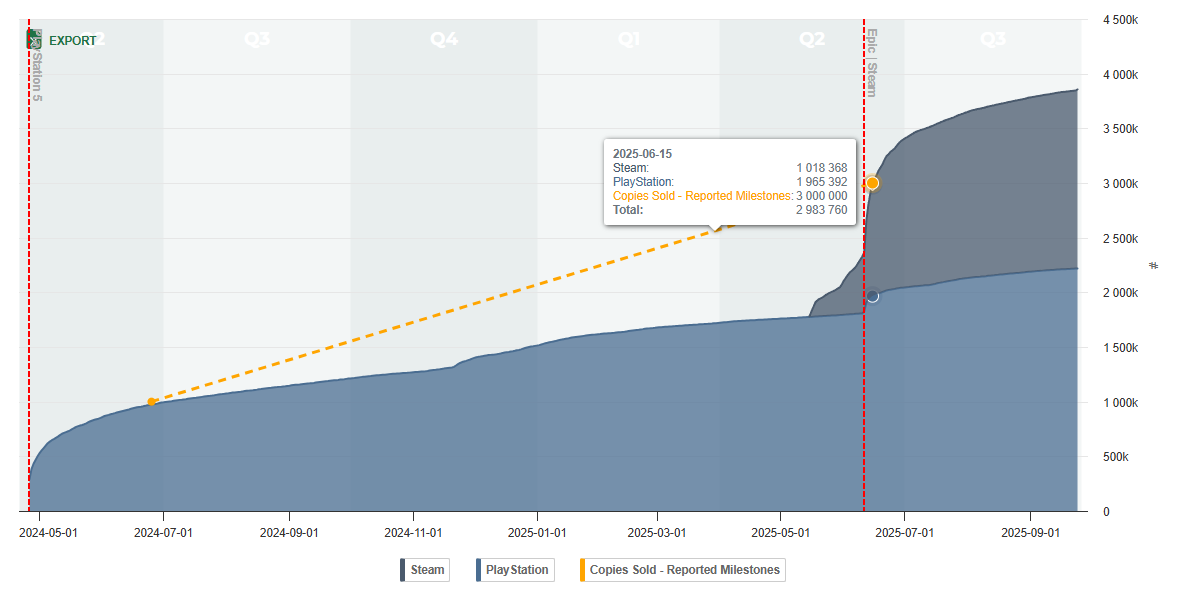

As the Alinea platform screenshot below shows, Stellar Blade’s success in China helped the game shoot past its officially announced 3 million copies sold milestone (which our estimates had a sub-1% margin of error on 😉):

I spoke to Shenzhen-based games consultant Daniel Camilo, who runs the rad Gaming in China Substack:

‘’Localisation is the single most important step to successfully launching a game in China,’’ said Camilo. ‘’Very closely followed by discoverability and its go-to-market strategy. If a game is not localised into Chinese, most gamers simply won’t play it. Most studios and their publishers understand this nowadays, as we’ve witnessed so many including Chinese-language options in recent years. Understanding the context of your game in China is crucial.’’

Subscribe to Daniel’s Substack, too. He’s a good dude and very knowledgeable about the Chinese games market.

You can increase your chances of success in China by:

Selecting the right local partner: To hedge your bets for the future, choose a local publishing partner that has license-submission expertise, community/marketing channels (Weibo, Bilibili, Douyin, WeChat), and regional QA/localisation talent experienced with NPPA back-and-forth. A partnership should contractually cover compliance workflows, approval milestone responsibilities, and post-launch live-ops Service Level Agreements.

Fostering community and trust: Host bilingual official communities, employ local community managers, and invest in in-country education messaging around youth protection. This reduces any imminent regulatory scrutiny and builds goodwill.

Playing to China’s festival calendar: Time and releases and events with the Chinese calendar, like Singles’ Day, Lunar New Year, and 618 to give yourself your best chances for UA and increasing ARPPU.

Some common mistakes for Western developers trying to cater to Chinese players

What works in the West doesn’t necessarily work in China. There’s some pitfalls to watch out for, like:

Treating China as a translation exercise: Superficial localisation – or worse, bad translation – can anger some Chinese gamers. And even a vocal minority not enjoying the game can skew the narrative in China – as we saw with WUCHANG earlier this year (culturally) and with Silksong this month (due to a bad translation). We’ve found that China’s gamers are more likely to use Steam reviews as a way to get their point across – as they often lack other international channels.

Relying solely on Western UA strategies: CPC/CPM acquisition is different in China, where social distribution is even more influencer-first than in the West. It’s not a copy-paste exercise.

For those launching officially, don’t underestimate approval timing: Assume that approvals may slip. And don’t hard-bind global launch calendars to uncertain Chinese approvals. Licensing freezes back in 2021 show how unpredictable things can be.

But ultimately, good games sell, no matter the market. Camilo hit the nail on the head when I chatted with him earlier this week:

‘’At the end of the day, however, if a game is good and properly localised to Chinese, it will eventually find its audience in China. Chinese gamers have historically shown how welcoming they are to games from all over the world and from different genres. In that regard, Chinese gamers are not much different from everyone else. Gamers recognise game. Quality should always come first.’’

Hear hear.

If you’re launching in China and want to see how well you – or your competition – are doing in the market, reach out here for a demo and trial of our platform, and we’ll show you.

Other insights, links, and cool stuff

We’ve announced some great new features for our platform, including our unified view across Xbox, PlayStation and Steam, and publisher actuals alongside our estimates. Blog and video here on the Alinea website.

Our data was in the press quite a bit last week, including our friends at GamesIndustry.biz and Insider Gaming covering our Borderlands 4 analysis – as well as the legends at wccftech covering our Tuesday newsletter

Want to have a look at our platform and get your hands on our data for yourself. Reach out here for a free demo and trial.

The last word

Reply to this email – or reach out here – if you have any feedback for the newsletter – or want to request a game for us to cover.

[Alinea Analytics boasts the most accurate PC and console estimates in the business. Game makers use our platform to understand their audience, keep an eye on the competition, monitor sales trends, and spot new opportunities. We equip game studios and financial institutions with accurate data and the confidence to make smarter, data-driven decisions. Want to talk about all things games market data? We’d love to chat!]