Games with co-op generated over $4 BILLION on Steam in H1 and have dominated our new release charts

It's the co-op deep dive edition! From R.E.P.O. and Schedule I to Monster Hunter and Split Fiction, 2025 has truly been the year of co-op on Steam. You love to see it.

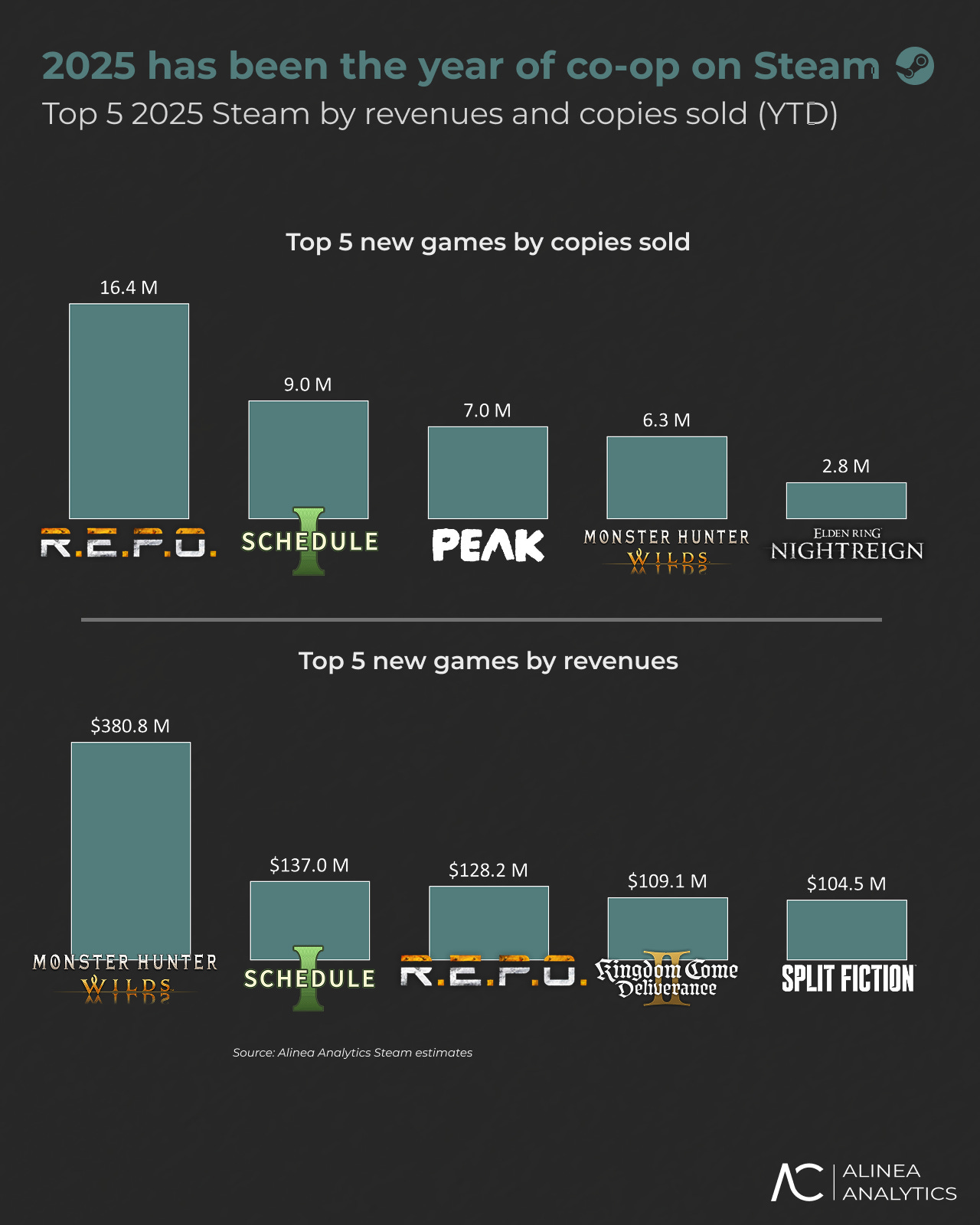

Steam’s top five games new this year so far (by copies sold) all have one thing in common: they’re all co-op based – and in many cases, co-op only:

Co-op is king, and Steam is the kingdom. If you’ve been paying attention to our newsletter – or looking in our platform (get your demo and free trial here) none of this should be a surprise to you, so hit subscribe below to stay ahead of the curve.

Co-op games have been on the rise on Steam for the past decade

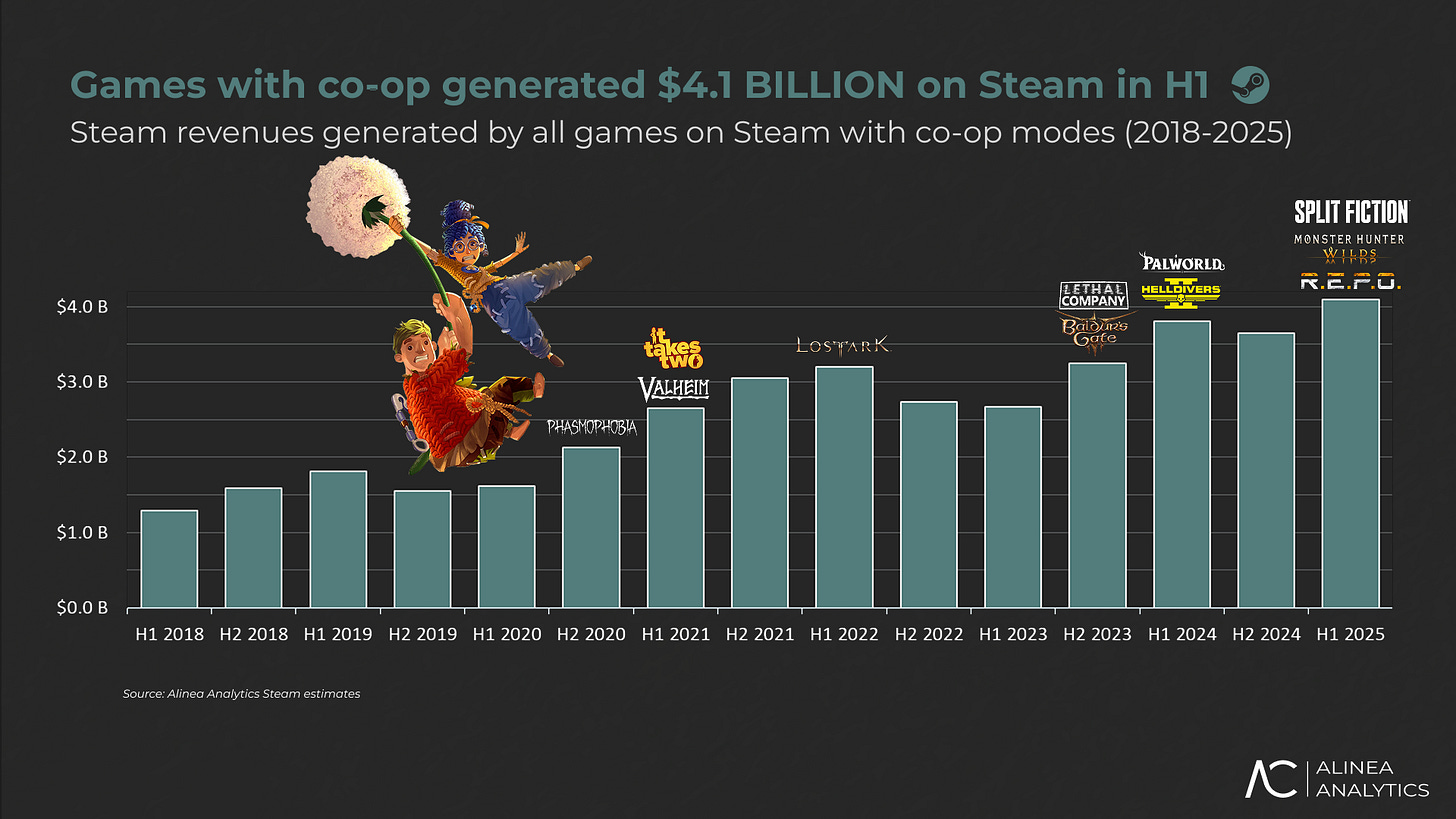

Our estimates show that games with co-op on Steam generated a staggering $4.1 billion in revenue on Steam in the first half of 2025 alone, the highest six-month total ever recorded for the genre.

That’s a nearly 11% jump from H1 2024 and continues a noticeable upward trend that began during the pandemic gaming boom:

And here’s how easy it was for me to pull that data from the Alinea Platform, which you can get a free trial of (unlimited access for 3 days) here:

The reasons for co-op’s rise to success are pretty clear. Co-op games sit at the intersection of social engagement, replayability, and creator appeal – three pillars of success for many games on Steam.

These factors – and the virality they lead to – is especially important for indie titles that can’t lean on a huge franchise or studio to get fans through the door.

Steam's algorithms also favour highly rated multiplayer games with longer tails, helping many of the breakout titles in the charts above stay visible.

Looking back at the data from the co-op hits from this year, one refreshing thing is how distinct they are from one another.

Indies AAA, AA, and live-service experiments have all charted – and across new IP and established franchises, premium and budget alike.

Let’s look at the data for the indies first.

Indie co-op games are crushing it in 2025

The indie scene has been a gold mine of quality, quirky, and quaint co-op games this year. Let’s start with R.E.P.O.

Left 4 Dead and its sequel set the world on fire with their take on quality horror co-op. And in the years since, indies like 2020’s Phasmophobia and Lethal Company 2023 have taken the mantle.

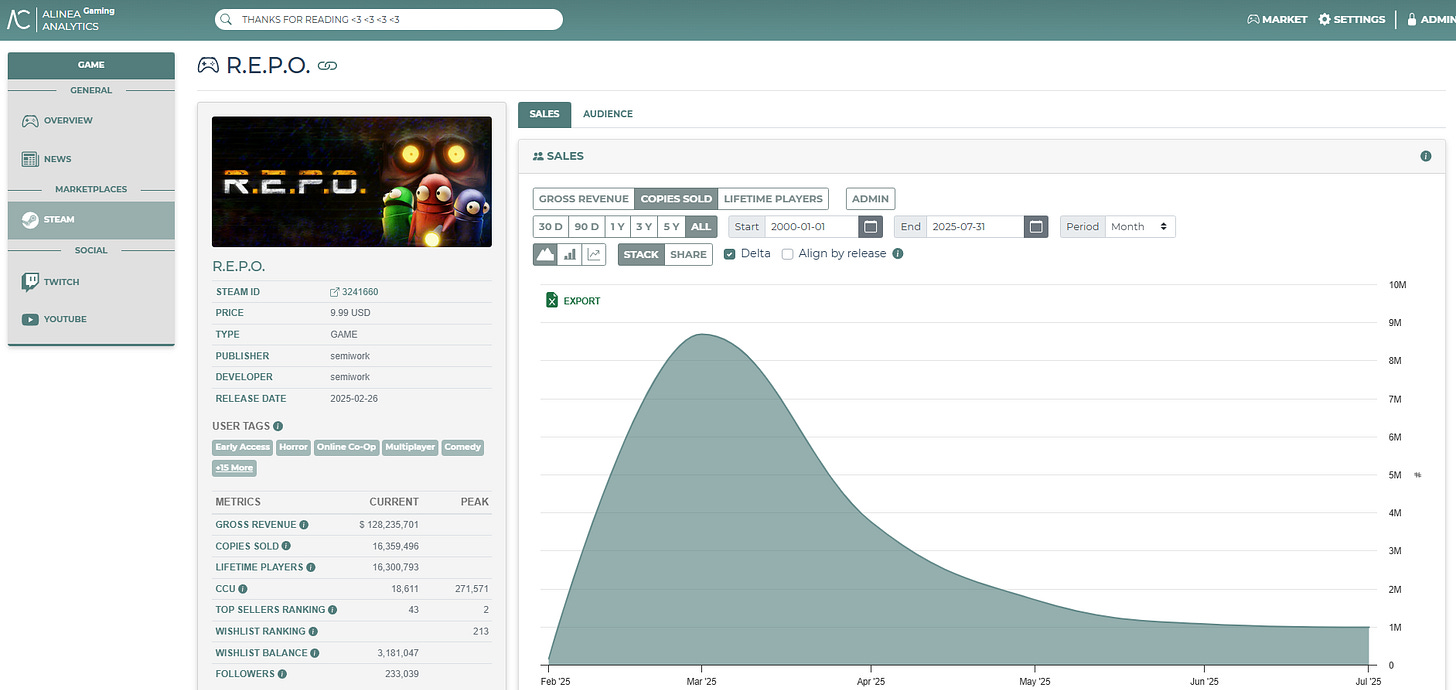

This year, the torch has been passed on to R.E.P.O., which launched in February and has already sold 16.4 million copies (#1 for this year) and generated revenues of $128.2 million (#3).

R.E.P.O’s accessibility (in price and learning curve), viral-friendly jump scares, silly physics, and horror elements have been a hit among players.

In terms of crossover, R.E.P.O. is appealing to those same gamers who previously loved similar indies, as about half of R.E.P.O players have also checked out Lethal Company or Phasmophobia.

And as you can in the Alinea platform screenshot below (demo and trial for ya!), R.E.P.O. is continuing to sell. It’s sold a million copies and generated $10 million in revenues this month:

We’ve also got Schedule I, the quirky drug-dealing sim that’s won over players with its dark humour, co-op chaos, and – again – accessibility in pricing and pick-up-and-play gameplay. It’s now crossed nine million copies sold on Steam, generating revenues of $137 million.

Together, R.E.P.O and Schedule I have generated over a quarter-of-a-billion dollars for the games market this year. Damn.

And then there’s mountain-climbing title PEAK, which launched last month and has quite literally been the talk of the town with its hilarious proximity chat function and goofy physics-based fun.

PEAK had been topping our weekly copies sold charts on Steam for quite some time and just crossed 7 million copies sold on Steam ($42 million in revenues owing to its $7.99 price point).

Budget indie games are generating more revenues than some AAA games from massive studios. And we’ll likely see more we haven’t heard of popping off before the end of the year.

But AA(A) has also been doing great

The top-grossing new Steam game was co-op creature-killin' RPG romp Monster Hunter Wilds, generating Steam revenues of over $380 million via 6.3 million copies sold on Steam.

Monster Hunter sold another 3.1 million copies on PS5 (the platform’s #2 new PlayStation game this year, after Forza Horizon 5, but #1 if we’re not counting ports. Monster Hunter has sold about 700 K on Xbox.

We can’t talk about AA co-op without mentioning Hazelight. And the It Takes Two developer hit it out of the park again this year with another co-op-only masterpiece, Split Fiction.

Split Fiction’s genre bending, tight platforming, humour, and timely critique of the generative AI bubble craze blend into one of the best games I’ve played this year.

And others seem to agree, as Split Fiction has now crossed $100 million in revenues on Steam alone (via 2.6 million copies sold. It’s sold another 2.5 million copies on PS5 and a million on Xbox. You love to see it.

Split Fiction’s success is no small feat, as each copy of the game includes a friend pass, allowing players to invite a friend to play with them for free. Fair play, Hazelight.

Even Elden Ring got in on it, and reigned

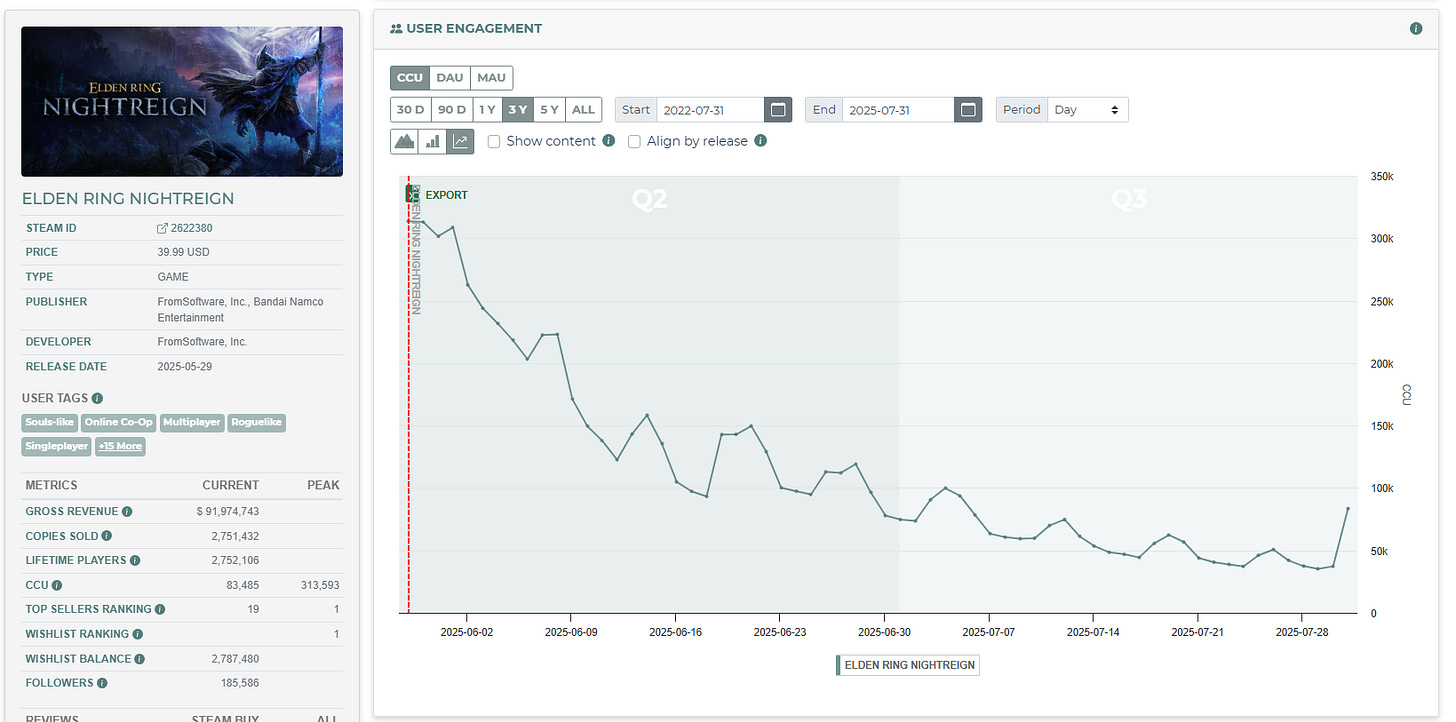

Finally on the AA(A) front, there’s Elden Ring Nightreign. FromSoftware's Souls games have always had some element of co-op, but Nightreign was their first proper go at a PvE co-op game.

FromSoftware didn’t reinvent the wheel here. Built in just a few years and leveraging many assets from the original game, Nightreign is a textbook example of efficient, high-impact game design.

Nightreign has now sold 2.8 million on Steam (revenues of $92 million), 1.5 million on PlayStation, and another 800 K on Xbox.

On Steam, Nightreign’s DAUs and CCUs had been rapidly declining. But as you can see in the Alinea Platform screenshot below, a new update yesterday brought some players back into the fold. And even before that, Nightreign never dropped below 200 K DAUs.

Engagement is dropping off, but it doesn’t matter, as FromSoftware has already generated over $150 million from this lean PvE experiment. Of course, it also helps when you’re building off of a titan, as the original Elden Ring has now sold over 30 million copies globally.

And the franchise’s players were very curious. 84% of Nightreign’s PlayStation players and 78% of its Steam players had played the original.

Nightreign also marks an important shift behind the scenes at From, marking the directorial debut of Junya Ishizaki, a longtime Souls design veteran.

And while Hidetaka Miyazaki remains the studio’s guiding hand, he’s clearly laying the groundwork for the next generation of talent.

Luckily for everyone involved, Nightreign was a clear success. Ishizaki’s off to a flying start, I reckon.

We’ll be keeping an eye on what comes next for both him and FromSoftware – but for now, Nightreign stands tall as one of the biggest launches of the year and another Raptor’s Black Feather in Steam’s co-op hat.

In the end, co-op has evolved from a feature to a foundational part of the games market. Not everybody wants to play sweaty PvP games – myself included – and co-op offers a way for gamers to hangout and have a laugh without the stress. Unless you’re getting scared shitless in R.E.P.O, that is.

Get a FREE trial of the Alinea platform

Want to get your hands on our data for yourself?

Reminder: we’re offering a free trial of our platform for games companies to coincide with gamescom 2025. Click this link and follow the instructions to get access.

Why don't other companies publicly give out estimates or offer free trials?

Honestly, most don’t have faith in their data.💁🏽 We’re not like that. To get your trial, just like this LinkedIn post on comment ‘’free trial’’ on it.

If you’re going to gamescom and want to meet up, let us know here! 📅📌

The last word

Reply to this email – or reach out here – if you have any feedback for the newsletter – or want to request a game for us to cover.

[Alinea Analytics boasts the most accurate PC and console estimates in the business. Game makers use our platform to understand their audience, keep an eye on the competition, monitor sales trends, and spot new opportunities. We equip game studios and financial institutions with accurate data and the confidence to make smarter, data-driven decisions. Want to talk about all things games market data? We’d love to chat!]