Ghost of Yotei is a success as Battlefield 6 sells 1.8M on Steam pre-launch

Today we’re looking at our estimates for two of Q4’s biggest games – the year's hottest PS5 exclusive and the most anticipated Battlefield launch ever.

Let’s start with Sucker Punch’s samurai success story (love a bit of sibilance).

Ghost of Yotei is Sony’s strongest first-party PS5 launch Spider-Man 2

After a week on the market, Ghost of Yotei is one of PlayStation’s most successful first-party launches of the PS5 generation, showing the enduring strength of the Ghost IP as a key PlayStation franchise.

Ghost of Yotei has sold 1.6M+ copies through to consumers (2M+ when we include sell-in to retailers), translating into nearly $100 million in revenue. It’s selling slower than Ghost of Tsushima, which shifted 2.4 million copies in three days.

But it’s worth noting that Ghost of Tsushima launched when the PS4 had an installed base of about 110M (compared to the PS5’s current 80M-ish) and during the height of the lockdown-induced gaming boost.

It’s safe to say that Sony’s samurai sequel is doing well for the company. Yotei made its dev costs (without marketing) back VERY quickly, an outcome that’s becoming rarer for huge AAA releases. More on that later.

I’ve been sinking my teeth into the game, and I’m constantly amazed by Yotei’s refinement and restraint:

Sucker Punch has shed the open-world bloat that took me out of the first game while doubling down on the core strengths of its combat system, world design, and presentation.

Atsu’s revenge-driven narrative, brought to life by Erika Ishii’s standout performance, is a major improvement over Jin Sakai’s more snoozy stoic arc in the first game.

Yotei is also bloody stunning – it’s one of the most gorgeous pieces of media I’ve seen. Adding the near-instant load times into the mix only proves Sony’s technical leadership on PS5 further.

Other PS5 fans are loving it too, with 30% of players having played Yotei for over 20 hours (in one week!). Player crossover data gives more insight into Yotei’s audience:

Ghost fandom: 93% of Ghost of Yotei players previously played Ghost of Tsushima, so most of the fans are returning.

Samurai genre lovers: Overlap of 30% with Sekiro and 27% with Assassin’s Creed Shadows shows an appetite for samurai- and Japan-themed action titles.

PlayStation Studios appreciation: Strong crossover with Spider-Man 2 (60%) and other prestige PlayStation titles like Helldivers 2 (28%), Astro Bot (20%), and Death Stranding 2 (18%) suggests Yotei is tapping into core PlayStation franchise fans. Yotei players have over 50%+ crossover with basically every AAA first-party PlayStation game, but PS Plus skews things there.

Digital purchases account for 77% of Yotei’s total sales so far, leaving just 23% physical, which is in line with Sony’s recent financials about its digital splits (76% digital in FY24, as per page 12 here).

Digital’s share has been growing over time, and that’s set to continue if Sony’s last-reported quarter is anything to go by.

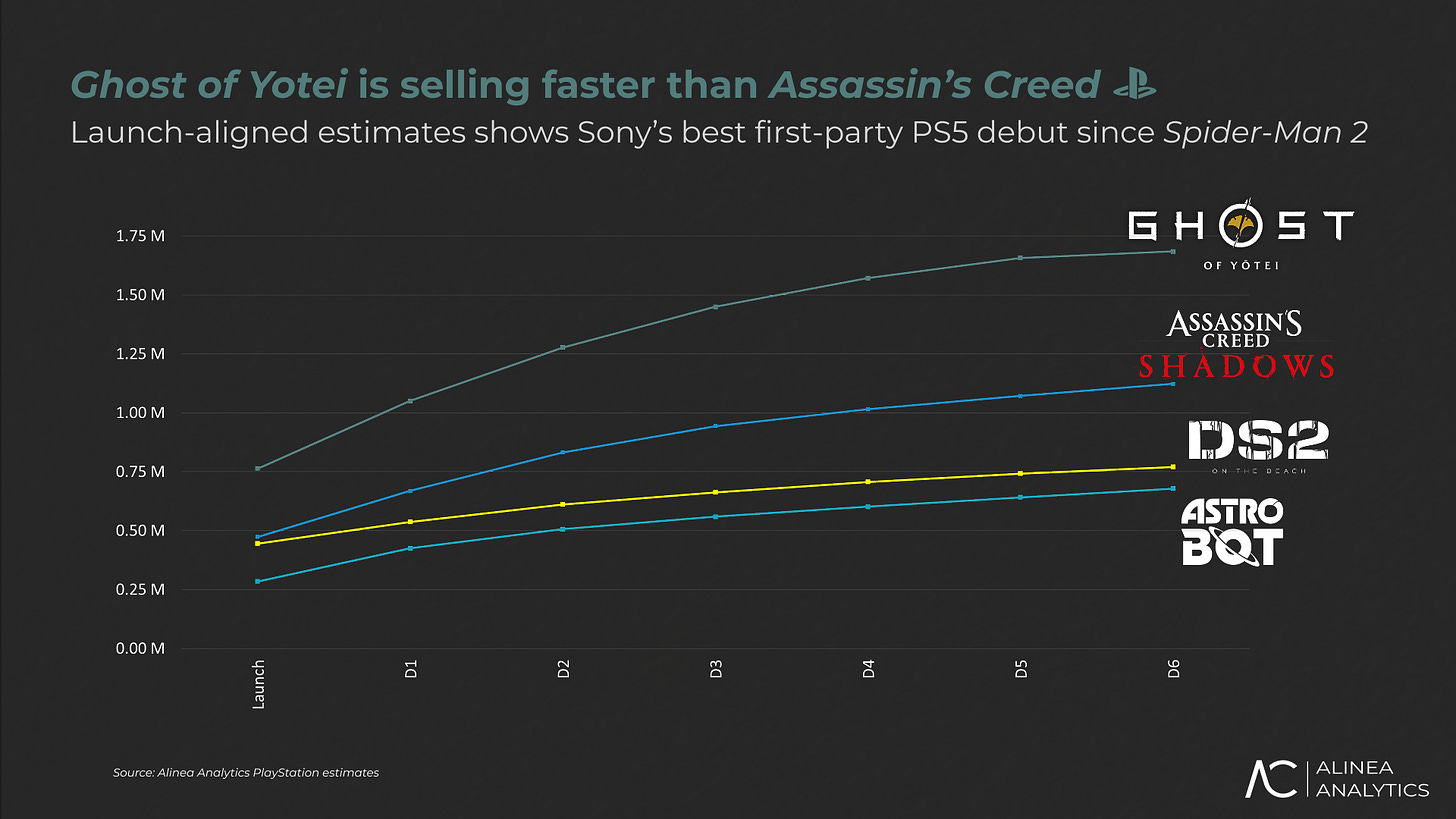

Ghost of Yotei is PlayStation’s first-party strongest PS5 launch since Spider-Man 2

Ghost of Yotei’s performance so far comfortably outpaces other high-profile first- and third-party PS5 releases from the past year, including Astro Bot and Death Stranding 2:

Relatively speaking, Yotei is also performing 1.5x faster than Ubisoft’s Assassin’s Creed Shadows (launch aligned). PlayStation, it seems, has won this year’s samurai showdown.

Ghost of Yotei is already an unqualified commercial success, but its margins might also be lower than you think.

An instant return on PlayStation’s investment

Sucker Punch’s CEO Brian Fleming recently revealed to Game File that Yotei’s development costs were roughly equivalent to Ghost of Tsushima’s.

Leaks from the Insomniac data breach put that budget at about $60 million, which is modest by AAA standards these days and won’t include marketing. Our estimates show that Ghost of Yotei made that back in the first few days.

Sucker Punch has a development team of about 150 core staff, supported by external outsourcing. The team’s efficiency relative to AAA, combined with PlayStation’s global marketing reach, has created an unusually favourable cost-to-return ratio for a AAA game.

And that’ll only continue over time, as there are a couple of product lifecycle boosts coming to Yotei next year:

Yotei Legends, a co-operative multiplayer mode for Yotei, is launching in 2026 as free DLC for Yotei buyers. Given the incredible success of co-op multiplayer games, including PlayStation’s own Helldivers 2, Legends could be a hit when it launches next year. And look at Elden Ring Nightreign from earlier this year, which has sold 5.5M+ copies as per our estimates. Sucker Punch actually already built a RAD multiplayer mode for the first game – it just has to expand on this and market it properly, especially to the PC crowd. On that note…

A 2026 Steam release, while unconfirmed, will give the game a substantial second wind. The original Ghost of Tsushima came to Steam last year, selling 2 million copies (almost $90 million in revenue). Sony will aim to replicate that trajectory here, with Yotei’s cross-platform expansion serving as a key long-tail driver into FY2026. The sweet spot for Steam ports is no more than a year after PS5 release (outside the live-service space). I reckon Sony will go for that here.

Both the Legends release and Steam port will broaden the audience and revenues into 2026. I have a theory that Legends will release day-in-date on Steam when Yotei is ported there – it’ll get those network effects going.

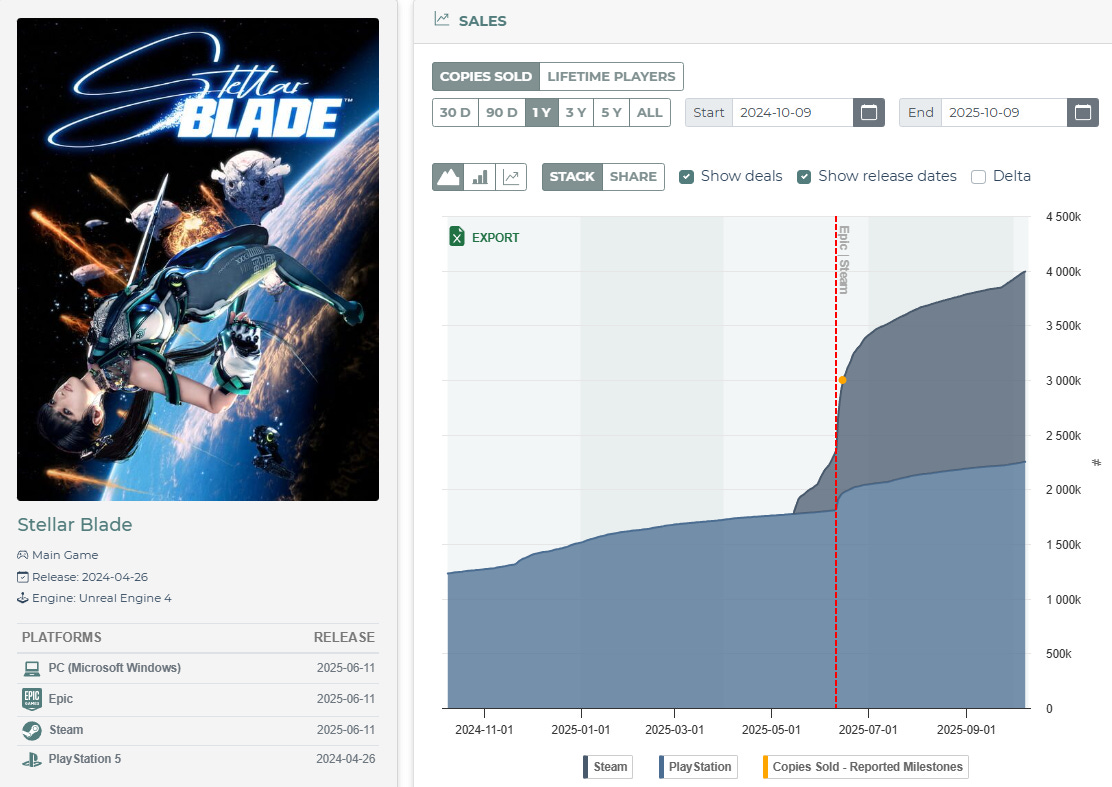

Network effects across platforms is pivotal for the survival of any online game. But Steam ports also have an extra advantage for Sony: they trickle into more sales on PS5 too, as shown by Stellar Blade’s PC port, which has now passed 4M copies sold.

Check out the PS5 sales bump in the Alinea platform screenshot below (get your free trial):

The title’s efficient production pipeline and robust early performance make it a standout example of a “mid-cost, high-return” model – one that Sony must increasingly rely on amid rising development costs in our now-mature games market.

Sucker Punch has cemented Ghost as one of PlayStation’s most valuable and enduring first-party IPs. Good thing, really, as there’s an anime based on Legends happening in 2027 (coming to Sony-owned Crunchyroll) and a movie on the way (from John Wick director Chad Stahelski).

From a strategic viewpoint, Ghost of Yotei’s success validates Sony’s ongoing first-party strategy: tightly managed budgets, strong IP continuity, and a focus on cinematic, high-quality single-player experiences that can later be extended through multiplayer modes, PC ports, and other media.

Sony said it itself in its 2025 Corporate Report, where PlayStation boss Hideaki Nishino lays out the following strategic key points for Sony’s studio business going forward:

‘’Advancing [the company’s] position as creative leaders in single-player experiences, broadening [the] business model and studio capabilities through diversification of live service offerings, and evolving IP franchises and portfolio strength by unlocking areas of growth beyond gaming while balancing profitability.’’

Ghost of Yotei ticks all those boxes.

That’s enough about swords. Onto guns.

Battlefield 6’s blockbuster pre-launch metrics continue

Battlefield 6 officially launches worldwide tomorrow. Our estimates show that it’s already sold over 1.8 million copies sold on Steam – that’s over $100 million in revenue on Valve’s platform alone.

Hype during the beta period has clearly converted into sales. And that hype is continuing. Battlefield 6 has 3.5M+ wishlists, a level of pre-release engagement never seen before in the franchise’s history.

Our Steam wishlist crossover data provides useful insight into audience overlap. Of Battlefield 6’s wishlisters:

13% have also wishlisted Arc Raiders

11% have wishlisted Deadlock

6% wishlisted the Steam version of Escape from Tarkov and Black Ops 7, respectively

The genre crossover points to a broader, more diversified audience than previous entries, which could help EA expand beyond its usual core of franchise loyalists. For EA, this is validation that the Battlefield IP still carries enormous commercial power when handled properly.

Beyond sales, EA is running an extensive Twitch Drops campaign to amplify launch-week engagement. Running from October 10 through October 17, players can earn cosmetic rewards for engaging with Battlefield streams.

Post-launch, Battlefield 6 will roll directly into a structured Season 1 roadmap beginning October 28, delivering monthly content ast no extra cost like maps, modes, weapons, and vehicles.

Seasonal updates will help sustain engagement across Q4, while the Portal Builder Tool will allow creators to extend the game’s lifespan through UGC experiences.

This mix of curated and community-driven updates aligns with EA’s ongoing push toward persistent live-service ecosystems. If retention holds through Season 1 and the game maintains positive sentiment at launch, Battlefield 6 could set a new benchmark for the franchise and restore EA’s position in the premium shooter market.

All signs, at least pre-launch, suggest Battlefield is back in the fight. Our estimates reflect a perfect storm of pent-up demand after years of missteps and a huge potential comeback narrative under Zampella’s stewardship.

The success of Battlefield 6 also lands against the backdrop of EA’s pending $55 billion leveraged buyout led by Saudi Arabia’s Public Investment Fund, Silver Lake, and Affinity Partners.

As I wrote in last week’s newsletter, this deal goes beyond financial engineering; it’s geopolitical theatre disguised as M&A. Yet, from a purely financial lens, Battlefield 6’s awesome start will make the buyout consortium breathe easier:

Battlefield’s early returns and long-tail potential across live service seasons are both positive signals.

In general, private-equity debt loves recurring revenue, and Battlefield 6’s battle passes, cosmetic packs, and seasonal content fit that template perfectly if the content treadmill runs as smoothly as it looks it will.

Battlefield’s successful launch, including the high-production story mode, also show that EA can still mint dependable blockbusters based on its legacy franchises. This is the kind of cash-flow predictability that leveraged-buyout math demands.

Internally, the success of Battlefield 6 will likely shield its developers from near-term cuts once the deal closes, but history suggests the debt service will come due elsewhere.

Single-player-focused studios like BioWare and Motive may not be so lucky when the “efficiency” rounds begin in 2027.

Alright, elephant in the room time.

There’s a darker irony here. The same Saudi capital fuelling EA’s privatisation is now indirectly underwriting one of gaming’s most overtly militarised franchises.

Battlefield 6 depicts modern warfare and through the lens of Western-style heroics and includes themes like war crime and human-rights issues – the kind of imagery the Saudi state is eager to sanitise via its cultural-investment and sportswashing push.

But for now, and getting back to the point of this newsletter, Battlefield 6 is a triumph so far, a well-orchestrated comeback for a beloved franchise. Fingers Zampell and the team can stick the landing.

We’ll be covering this one in more detail as more data comes in. Hit subscribe below for free to get that data in your inbox when it’s ready.

Get a FREE trial of the Alinea platform

Want to get your hands on our data for yourself?

We’re offering a free trial of our platform for games companies. Just reach out here, or reply to this email, and we’ll set you up.

The last word

Reply to this email – or reach out here – if you have any feedback for the newsletter – or want to request a game for us to cover.

[Alinea Analytics boasts the most accurate PC and console estimates in the business. Game makers use our platform to understand their audience, keep an eye on the competition, monitor sales trends, and spot new opportunities. We equip game studios and financial institutions with accurate data and the confidence to make smarter, data-driven decisions. Want to talk about all things games market data? We’d love to chat!]

This is all untrue. The 2 million number is based off a single fake fan photoshoot that admittedly looks cool but admits to being fake. The 1.6 million number is from an X account with no proof of its statements. And worst of all, Sucker Punch has made no statement about sales numbers yet. In fact, they haven't posted on X for 2 days now.

They would be posting this everywhere if it were true. The game will sell well, but will it sell as well as it could've without all the controversy surrounding it?

Jin sakai was "snoozy and stoic" while Erika ishii gave a "standout performance" with atsu, huh? What a joke. There was was barely any emotion in atsu's VA until the end of the game and even then it was a pretty weak performance. The guy who plays Jubei did a way better job than Erika ishii.