June’s Steam top 10: SEVEN 1M+ sellers, with plenty of new games, sales, and indie success stories

But also: why investors and publishers are obsessed with wishlists, two H2 games to watch, and a look at how we approach our estimates (including some benchmarks).

A lot’s happened in the past month, so let’s waste no time. But first, let’s kick off with why everyone’s obsessed with wishlists.

What’s up with the wishlist obsession among publishers and investors?

Simply put: On Steam, wishlists are one of the few proprietary metrics gaming studios can access for their own game before release. It’s a go-to metric.

But the conversion rates from wishlists to sales are a different, more uncertain question. There’s a lot of variation. Our CTO, Viktor Spindler, has been combing through the data and – as he typically does – found something insightful.

Higher wishlist numbers often lead to more conversions. On average, games with over 500 K wishlists at launch convert 19% of wishlists to buyers a day after launch, 26% a week after launch, and about 32% a month after.

The chart below shows wishlist conversions for games that launched on Steam in H1. The fewer the wishlists, the lower the conversion rates:

That’s why huge wishlist numbers are a great tell for success stories. More than 2 million wishlists before launch is a sure-fire hit.

As promised, here’s two H2 games that are doing very well in terms of wishlists: Dying Light: The Beast comfortably has over 2M, and Borderlands 4 is looking good. If you leave a comment below or reply to this email, I’ll send you the exact numbers (and maybe a few other exclusive insights 👀)

Alright, onto the June ranking.

June’s top Steam games by copies sold: PEAK performance (sorry, expect puns)

We already touched on it in last week’s newsletter, but co-op climbing title PEAK has climbed even higher. It sold over 3 million last month, but now it’s reached 3.5 million. That’s almost $20 million in revenues.

Indie titles in general are continuing to smash it, as ever. There’s even a cohort of Steam players who play pretty much every co-op indie, with plenty of crossover:

61% of PEAK’s player base on Steam also played R.E.P.O.

Around 40% of PEAK players have played Content Warning.

30% of PEAK players have checked out Chained Together or Lethal Company.

Co-op sells on Steam, especially if it’s weird, wacky, and – perhaps crucially – streamer-friendly and shareable via short-video platforms.

Rematch also scored big

Rematch sold 1.1 million copies on Steam last month. But it’s continuing to climb up the league tables with 1.3 million sold and revenues of $30 million in revenues.

It’s also doing well on PS5, with 563 K copies sold.

Publisher Kepler is really on a kick right now – last football pun, promise – as it also published this year’s brilliant Clair Obscur: Expedition 33. Via these two games alone, Kepler has pulled in $120 million on Steam and counting.

Thanks to our unmatched pre-launch Steam metrics, we saw Rematch’s success coming, as seen in this article we contributed to for our friends at GamesIndustry.biz.

Rematch took a strike where others fumbled the ball (promise: broken). Titles like Knockout City and Destruction AllStars took cues from Rocket League but misread the playbook, focusing on flash over the football fundamentals.

Rematch, on the other hand, stays grounded and puts football at the forefront, appealing to both sports and competitive action fans, with data showing strong crossover from Rocket League and FC 25 players.

On PlayStation, for example, 60% of Rematch players have played FC 25, while 88% have played Rocket League.

At Rematch’s core is a simple set of mechanics that are immediately accessible, yet designed with the kind of depth that really rewards precision and mastery. Rematch is a football-infused evolution of the fighting game formula.

Quick hits: These games also sold over a million – and they’re all diverse and target mostly different audiences

Among June’s other million-plus sellers on Steam were:

Elden Ring Nightreign (#4), which sold another 1.1 million copies to hit 2.5 million sold on Steam overall (on top of the 1.3 million on PlayStation). Nightreign’s DAUs on Steam are declining quite rapidly. It was partly an experiment to train the next generation of FromSoftware leaders. It’s also generated over $84 million on Steam alone. And on a lean budget to boot.

Stellar Blade (#5), a PS5 port that we covered in detail last month, sold 1.1 million in its release month. Over half (54%) of its players were in China. Developer Shift Up’s decision to price locally in China and dub cutscenes in Chinese clearly paid off. To date, Stellar Blade has sold 1.4 million on Steam ($68 million).

R.E.P.O (#6) also sold another 1.1 million last month, bringing the indie’s total to 15.5 million sold. Co-op horror sells when done right. And R.E.P.O’s $121.7 M in revenues suggests it was – indeed – done very right. A timely price drop from $10 to $8 helped R.E.P.O shift over 70 K copies in one day at the end of the month.

Dune Awakening (#7) sold 1.1 million copies in its launch month alone. Dune is now at 1.3 million sold, over $50 million in revenues, and sitting on plenty of wishlists. We’re certain that Funcom will drop the price at some point to give sales a boost soon-ish.

Toby Fox’s Deltarune Chapters 3 and 4 finally arrived on June 4, marking a major milestone in the game’s long development arc. Deltarune sold 788 K copies in June and brought in over $15 million. About 40% Deltarune’s Steam audience is in the US – and 63% of buyers had already played Undertale. The legacy of Deltarune’s predecessor runs strong.

A long month ago in an indie farm, farm away…

Meanwhile, EA has once again leaned into its now-regular end-of-H1 fire sale strategy. In June 2025, Star Wars Battlefront II force-jumped back onto the Steam charts, landing at #9 with 751 K copies sold.

The spike in sales for this 2018 title was driven by a steep 90% discount, part of EA’s broader seasonal pricing push. For a fraction of its original price, players received not just the base game but a version packed with every cosmetic ever released.

Rounding out the top 10, Stardew Valley harvested another 583 K copies sold on Steam in June, also driven by a discount – 50% off to $7.50.

Discounts are familiar territory for the farming sim, as our data shows that Stardew has a proven track record of spiking in sales during discount periods. Here’s a quick screenshot from our platform showing some of those Steam spikes in action (the yellow line is price):

Want to discover how pricing data affects game revenues or copies sold on Steam and PlayStation? Our platform has that data. Let us know and we’ll show you.

The takeaway is clear: Stardew Valley remains one of the most consistently performant legacy titles in the indie space, with discounting still an effective lever for engagement and revenue.

It’s a testament to both the game’s long-term appeal and its evergreen visibility on storefronts. Even nearly a decade after release, it continues to convert new players at a remarkable rate, particularly during major sales events.

A note on Alinea’s methodology: Why we don’t update our numbers to match publishers’ announcements

We never revise our estimates 1:1 with public milestones, then claim it’s our data. But why? Trust. It relies on transparency and consistency in any data-driven industry, but especially in gaming.

Most publishers never disclose their sales and player numbers, so estimate models MUST be independent of the few public announcements we do get.

At Alinea, we’re pleased that so many companies use our data to inform high-stakes decisions. But we also feel it’s our responsibility to let stakeholders know about different approaches.

After all, we’re all in this together, so it’s in everyone’s best interests to fully understand the accuracy behind the information the market relies on.

We’re proud of what we’ve built. And we’re committed to staying objective, reliable and transparent in our estimates.

We cannot, in good faith, revise our estimates selectively based on public milestones and still maintain the integrity of our overall accuracy tests. It would be disingenuous to our clients and the market at large.

Instead, we let our model stand on its own. Our accuracy has proven itself in practice. That credibility comes from a clear awareness of both strengths and limitations.

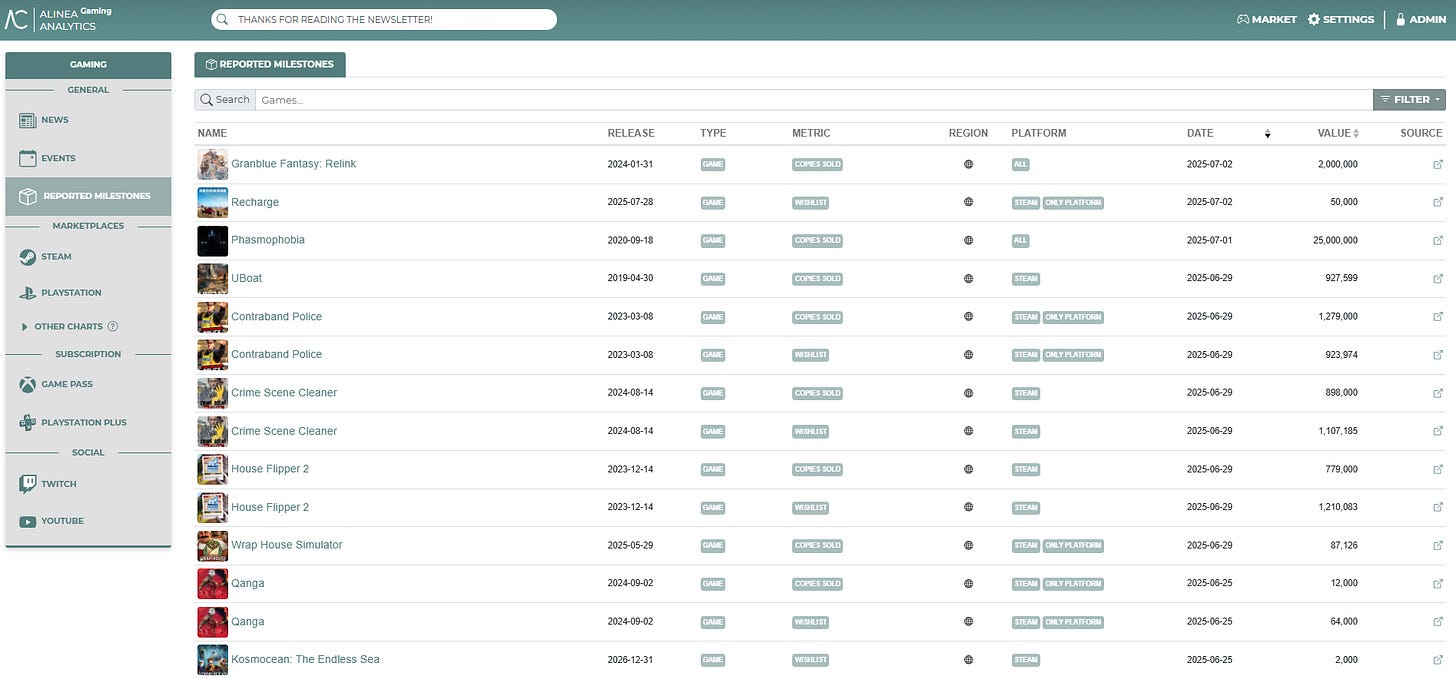

Transparency is a core Alinea value. That’s why – in addition to our estimates – we also provide one of the most comprehensive public milestone databases in the industry.

Our platform has over 25,000 curated public announcement entries, each with full source traceability. Here’s a quick screenshot of what that looks like:

This gives clients a rigorous, reliable estimation framework AND a rich curated milestone database, supporting informed decisions at every step. It’s the best of both worlds.

Our database lets us benchmark our industry-leading accuracy whenever a publisher chooses to release sales or player data.

But you can trust that an Alinea estimate is an Alinea estimate – and not a number plucked from a public announcement.

Want to learn more or see our data in action? Shoot us a message and we’ll give you a trial.

Other insights, links, and stuff

Want to learn more about the new games on Steam that did well last month in terms of revenue? Look no further than this killer LinkedIn post from our very own data guru, Marcus Adamsson.

The biggest gaming news this week so far is also the saddest: the Xbox layoffs. You can find Rhys’s analysis on what happened and what’s next in his LinkedIn post. Our thoughts are with those affected, including many of our friends.

On a more positive note, our gamescom 2025 tickets are all sorted, and we cannot wait to meet you all. Want to say hi? Reach out here, via any of us on LinkedIn, or wherever you want, really. We’ll show you that Scandi and Welsh charm – well, that Scandi charm, anyway.

The last word

Reply to this email – or reach out here – if you have any feedback for the newsletter – or want to request a game for us to cover. Also, tell your friends about us, subscribe, and all that!

[Alinea Analytics boasts the most accurate PC and console estimates in the business. Game makers use our platform to understand their audience, keep an eye on the competition, monitor sales trends, and spot new opportunities. We equip game studios and financial institutions with accurate data and the confidence to make smarter, data-driven decisions. Want to talk about all things games market data? We’d love to chat!]

#Battlefront3

Steam doesn't share sales numbers