October’s top PlayStation games by copies sold

Four new games – including Battlefield 6 and Ghost of Yotei – entered the top 10. Meanwhile, sports and long-standing franchises continue to dominate.

The Q4 sales and engagement spikes are in full swing. October was another massive month for new releases on PS5, but familiar classics also dominated our October PlayStation copies sold chart.

Let’s check it out.

Battlefield 6 marks a triumphant return

While it was close between the top three, Battlefield 6, which launched on Oct 10, took the October top spot with 3.2M copies sold on PS5 as per our estimates.

After the troubled performance of its predecessor, BF6’s dev teams rebuilt trust through a sharper competitive design, large-scale dynamic maps fans love, and major marketing that leans on everything that makes Battlefield great. We covered Battlefield 6’s successful launch here.

Season 1 and Battlefield’s free-to-play REDSEC mode launched on October 28. The timing was no coincidence:

The highly anticipated ARC Raiders launched on October 30 and has since sold over two million copies across all platforms.

Call of Duty Black Ops 7 is around the corner; as we told GamesIndustry.Biz last week, ‘‘Call of Duty has an entrenched global audience across consoles and PC – including more casual gamers – that purchases the game each year out of habit and brand loyalty.”

Valve could drop Deadlock at any moment. This is important, as over 27% of Battlefield 6 players on Steam have already played Deadlock’s early build

Either way, REDSEC has brought plenty of new players into the fray ahead of a competitive period for this zero-sum genre. Engagement began to taper off for Battlefield 6 two weeks after launch (that’s typical for live services), but the live ops strategy quickly changed that:

There has been some player backlash around REDSEC’s more aggressive monetisation, which is standard in the free-to-play space. Yet, some of the early in-game battle pass challenges are pushing unwilling Battlefield 6 players into the REDSEC mode, also causing some frustrations. Understandably so, really.

Still, REDSEC is showing impressive engagement signals so far, and EA has been receptive to player feedback until now. Battlefield 6’s trajectory remains strong.

FC 26 continues to perform, as Ghost of Yotei launches to sales success

FC 26 shifted another 3M copies on its lead platform (PlayStation consoles) last month. This is down -41% from the 5.1 million it sold in its launch month of September.

EA’s soccer cash cow continues to tower as a dependable yearly revenue anchor for PlayStation. FC 26 has now sold over 8 million copies on PlayStation consoles, with 88% on PS5. Across all platforms, FC 26 has sold 12M+, which is largely in line with its predecessor.

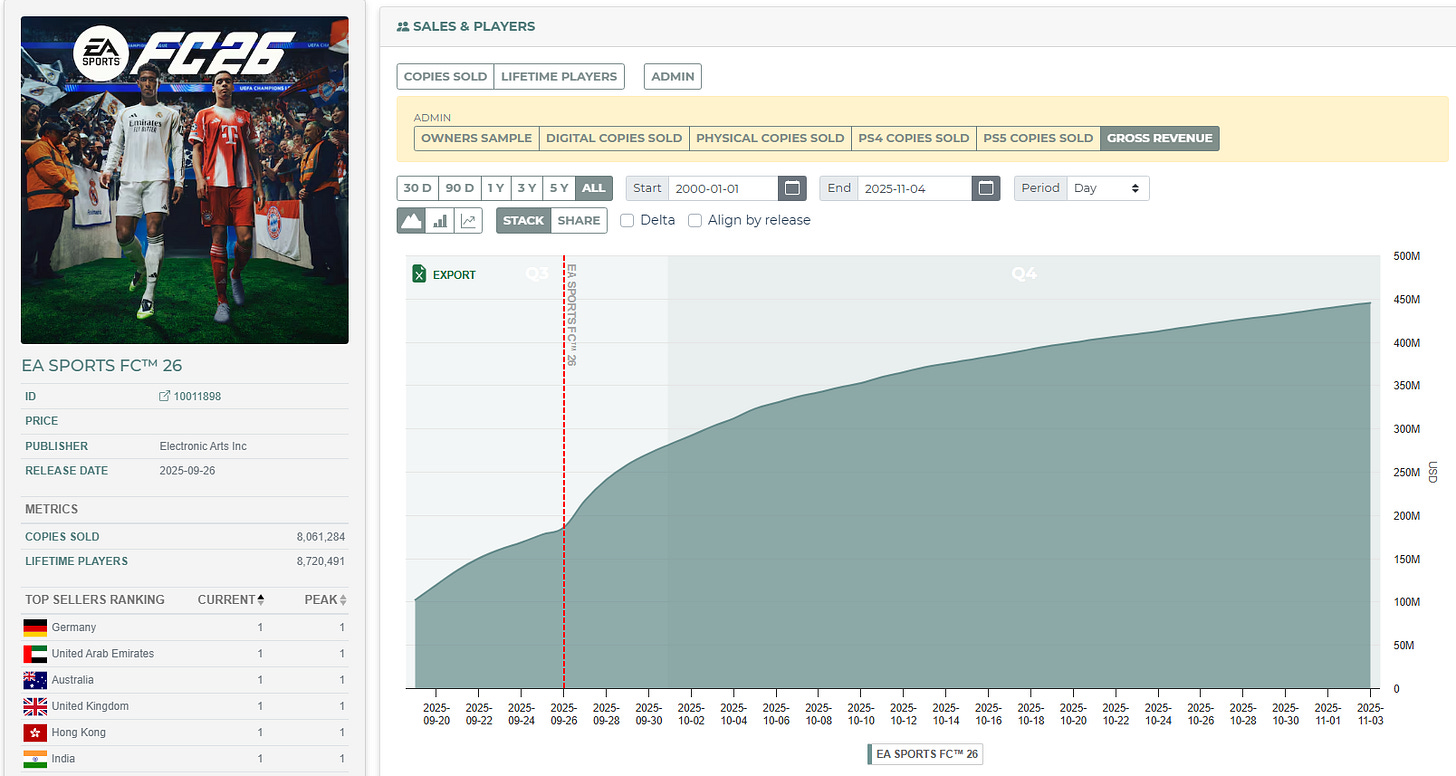

Boxed and digital copies of FC 26 have accounted for over $130 million in revenue for PlayStation this quarter, thanks to the 30% cut it takes from each game.

Here’s a sneak peek at our copies-sold revenue data on PlayStation:

And that’s not including the vast live-service revenue generated by Ultimate Team. Our estimates show that EA’s strategy of weekly themed events kept engagement extremely sticky throughout October, maintaining high conversion across regional soccer markets.

With seasonal competitions starting and holiday deal cycles approaching, FC 26 will likely stay on our PlayStation top 3 until the end of the year.

Want that ranking in your inbox? Hit subscribe below.

Meanwhile, Ghost of Yotei, Sony’s highest-profile single-player exclusive in years, launched last month and sold 2.7 million copies. It’s selling a little slower than its predecessor, but it’s worth noting that the PS4 had a bigger installed base than the PS5 has now.

Yotei will continue to sell decently ahead of awards season and the holidays and is on track to pass 3M copies sold soon. Learn more about what made Yotei such a success here.

The Ghost series has evolved into a flagship franchise for PlayStation. But Sony needs to be careful when it comes to overmining this franchise, which they’ve arguably done with Horizon IP.

The usual suspects take the next six spots

Familiar faces and other recent big sports launches filled the next several spots:

As you can see:

Minecraft (#4) continues to defy traditional sales curves, with another 635K sold on PlayStation in October, up 39% from September. The spike is due to the Copper Age update (content-driven rebuys), continued adoption on new PS5 hardware, and early holiday shopping. Minecraft’s role as a console entry point for young gamers ensures reliable volume every single month – a trend unlikely to slow anytime soon.

NBA 2K26 (#5) sold over half a million copies on PlayStation in October, settling nicely into its post-launch equilibrium after launching at the end of September. While the 72% month-on-month decline seems large on paper, it reflects the usual shift from unit sales to revenue from MyTEAM and seasonal live-ops events. FC’s decline was a lot softer (-30% versus -72%), as NBA launched at the start of September and FC at the end, so FC’s week-one sales also spilled into October. With the NBA season now in full swing, we expect to see 2K26 benefiting.

FC 25 (#6) sold another 350K last month. Even with the newest entry thriving, FC 25 holds value as a lower-price alternative. EA has strategically embraced this, knowing that mass-market regions – where cost sensitivity is high – are still converting decently. It’s a revenue-maximising strategy that EA will keep in its playbook for as long as it can.

GTA V (#7) sold over 300K last month (12 years after its original launch!). In other news, water is still watery, and the sky is blue-ish (well, it’s more grey-ish here in ‘’lovely’’ the Netherlands). Anyway, GTA Online updates and bundle discounts keep GTA 5’s long tail unstoppable. It remains the gold standard of multi-year engagement and is still one of the most profitable entertainment products of all time. And – in case you didn’t hear – there’s another one around the corner.

Madden 26 (#8), which launched in August, sold over 250K last month, down from a little over 400K in September. Madden 26 has sold almost 3.5M copies since launching (1.6M on PlayStation). It’s following the typical seasonal rhythms. Once the NFL season is in motion, purchases slow while player engagement trods on and new players slowly trickle in. October’s results are fully in line with expectations.

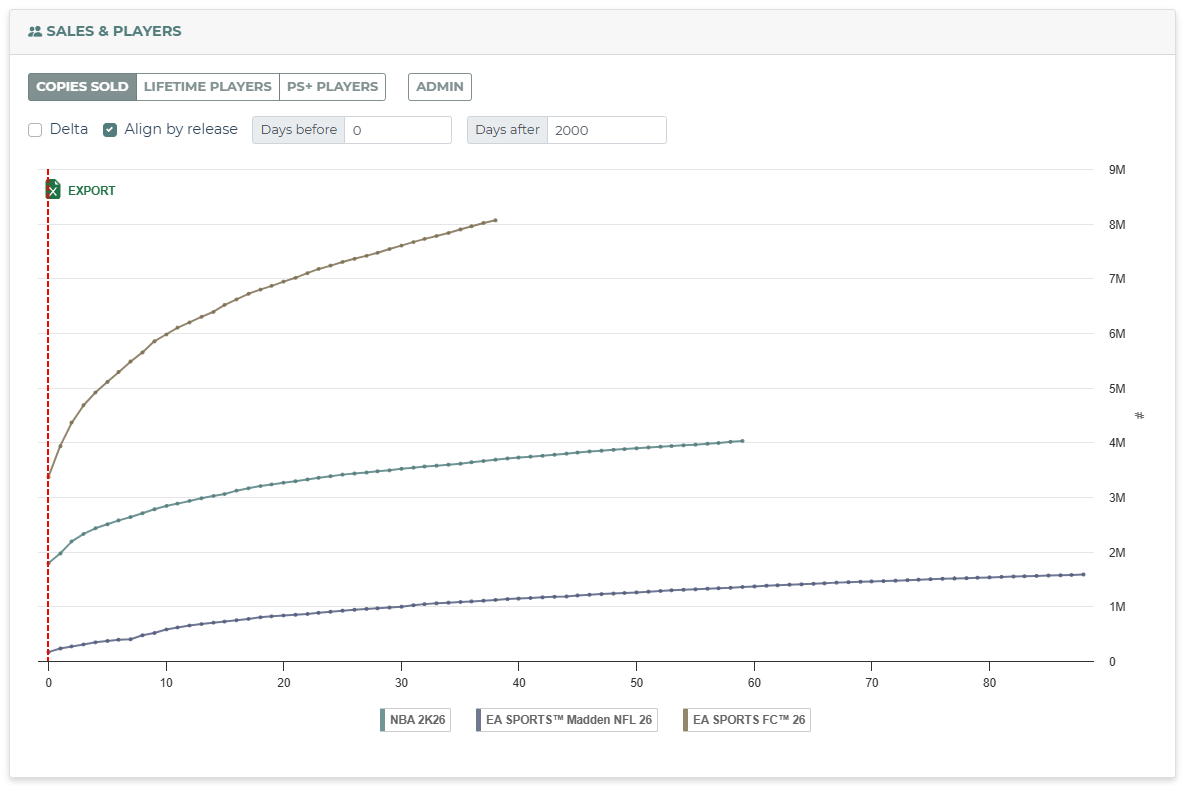

As for which licensed sports game is selling best, the answer is the same as every year: it’s the soccer one. FC 26 is selling twice as much as the next-best-selling licensed sports game on PlayStation, and it’s been out for less time:

We can see that the curve for FC 26 (top one) is both steeper and way higher, showing sustained and fast global demand rather than a shorter spike.

Things like this are why it make sense to look at global metrics – not just the U.S.-based data – to get a true litmus test of what’s happening in the industry. These kinds of differences often go beyond sports.

Our data covers all markets, so if you fancy seeing it in action, reach out here for a demo and free trial.

Back to the top 10.

Two new October games round off last month’s top 10

Little Nightmares III sold decently in its debut month, almost hitting 250K on PlayStation. It’s nearing a million sold across all platforms, but Little Nightmares III has not made the same splash as its predecessors, which were made by Tarsier Studios. Supermassive made Little Nightmares III.

Tarsier is currently working on REANIMAL, which is seen by many as the true successor to the first two Little Nightmare titles. REANIMAL’s Steam Next Fest demo enjoyed high engagement and even higher acclaim.

While slightly overshadowed there, Little Nightmares III has benefited from strong franchise recognition in the indie horror space and streamer-friendliness. It’s not a mass-market title, but its legs (all eight of them?) will probably remain long through spooky-season replays. Launching it in October was obviously also a smart choice.

Finally, Digimon Story: Time Stranger sold 241K copies on PlayStation in its debut month. It’s nearing a million sold across all platforms, with Steam accounting for over 60%. It’s the seventh game in the Story subseries and the first in eight years.

Time Stranger has been another quietly successful entry driven almost entirely by core fans of the franchise. On PlayStation, over 40% of Time Stranger’s players played the Digimon Story series’ previous game, 2018’s Cyber Sleuth - Hacker’s Memory, while 23% played 2022’s Digimon Survive.

However, Time Stranger’s turn-based RPG mechanics and nostalgia-driven storytelling could also be a compelling offering for anime and JRPG fans.

All in all, October was another eventful one for game sales on PlayStation consoles. Some key takeaways before we wrap up:

The blockbuster comeback is real: Battlefield and Ghost of Yotei signal that AAA games, live services and single-player alike, are still thriving on console. The ‘‘CoNsOlE iS DeAd’’ narrative is getting annoying. Xbox as a console is dying, yes. But let’s not extrapolate that too far, eh?

Evergreen content keeps climbing: Games like Minecraft, GTA 5, and even last year’s sports games are continuing to sell well. The number of amazing games on the market is growing, and backlogs are growing. It’s cumulative. This is a threat to any new game going forward, but luckily, there’s a cohort of players who love playing all the latest and greatest, even in trying economic times.

Sports control the revenue spine: EA owns four of the top 10 spots again. Sports games do best on console, and they sell gangbusters. Again, console, evidently, not dead.

Variety shows how wide the market is: Horror and anime RPGs are thriving alongside mainstream shooters and sports.

Roll on, November! ARC Raiders is already doing gangbusters, Black Ops 7 is coming, and there’s probably an indie game we’ve never heard of about to explode.

Get a FREE trial of the Alinea platform

Want to get your hands on our data for yourself?

We’re offering a free trial of our platform for games companies. Just reach out here, or reply to this email, and we’ll set you up.

The last word

Reply to this email – or reach out here – if you have any feedback for the newsletter – or want to request a game for us to cover.

[Alinea Analytics boasts the most accurate PC and console estimates in the business. Game makers use our platform to understand their audience, keep an eye on the competition, monitor sales trends, and spot new opportunities. We equip game studios and financial institutions with accurate data and the confidence to make smarter, data-driven decisions. Want to talk about all things games market data? We’d love to chat!]