Silksong passed 5M players in three days

That includes over 3 million copies sold on Steam. Read on for more metrics and analysis on Team Cherry’s phenomenal sophomore effort.

I’ve managed to tear myself away from the splendour of Silksong to deliver you an analysis on … Silksong.

Let’s go, so I can get back to getting pulverised by Pharloom’s finest.

Silksong smashes through the Metroidvania ceiling

Silksong launched on September 4. At last. We all knew it’d do phenomenally well (well, most of us…), but Silksong’s performance so far has been staggering.

Across all platforms, Silksong has pogo’d (diagonally, mind you) past 5 million players, including over a million via Game Pass console.

On Steam alone, Silksong has sold over 3 million copies in just three days, generating $50 million in revenue. That makes it the single biggest indie launch we’ve ever tracked in that time period.

The hype was real

Silksong goes far beyond just another sequel doing good numbers. It entered launch with 5.2 million wishlists on Steam, the most of any 2025 game.

Expectations for Silksong were stratospheric, and Team Cherry delivered – as we knew it would.

After all, the original Hollow Knight is among the most beloved indies of the past decade. Several million players – including myself – fell in love with its impeccable design, razor-sharp combat, and deeply atmospheric world.

Every room felt like it held a secret worth finding, every boss was a challenge to mastery, and the art direction and sound design are timeless.

Hollow Knight broke out of the Metroidvania niche entirely. Now, Silksong is gliding silkily across that first game’s mystique. Inertia, baby.

The drip-feed that built a phenomenon

Part of what made Silksong’s launch so explosive is the way it was marketed – or rather, not marketed.

Updates were sporadic, sometimes a year apart, but each new snippet – a blog post about enemy design, a release confirmation, or even an edit to the Steam page – became an event.

In a world where most publishers equate constant visibility with relevance, Silksong thrived on mystery in the years leading to its launch, which was announced just two weeks in advance. The community treated breadcrumbs like banquets, and now that the full meal has finally arrived, they’re devouring it.

This phenomenon can only be replicated by a few games – if any. So copycats beware. But there’s still a lot to learn from its launch data.

A global hit

Silksong’s top two Steam markets mirror most major PC hits, with the US and China leading, but Russia, Japan, and Brazil round out the top five.

However, it’s worth noting that the Chinese translation drew a bit of ire from a vocal minority in that country. But that’s been a bit overblown, as always.

On PlayStation, the player split looks a little different to Steam, with 30% from North America, 14% from East Asia, and 14% from Western Europe.

Yes, we have country and regions splits for every country in the world (not just a few cherry-picked easy ones 💚). If you want to see that in action, reach out here for three days of unlimited access to our platform.

Naysayers were proven wrong instantly

Some sceptics argued that the ceiling for Metroidvania games was only a couple of million copies.

That argument was already hilariously outdated (Dead Cells and the original Hollow Knight alone proved otherwise), but Silksong has buried it completely. And it’s also tarnished a reputation or two.

Speaking of Tarnished, a similar ‘’lower ceiling’’ argument was said of souls-likes before Elden Ring showed it can have mainstream appeal. Different scales and ceilings, sure, but a similar fallacy all the same.

There’s a lot of shared DNA between souls-likes and the two Hollow Knight games. More on that later.

Looking at social chatter or Google Trends is, of course, a decent indicator of success for some games. But it’s not enough to measure a game like this, one with minimal marketing.

Wishlist data told the real story – and Silksong had the strongest wishlist foundation of any indie ever. But that’s partly due to its long production cycle, of course.

We have the best wishlist data in the biz, by the way. Reach out here to see it in action via a free trial.

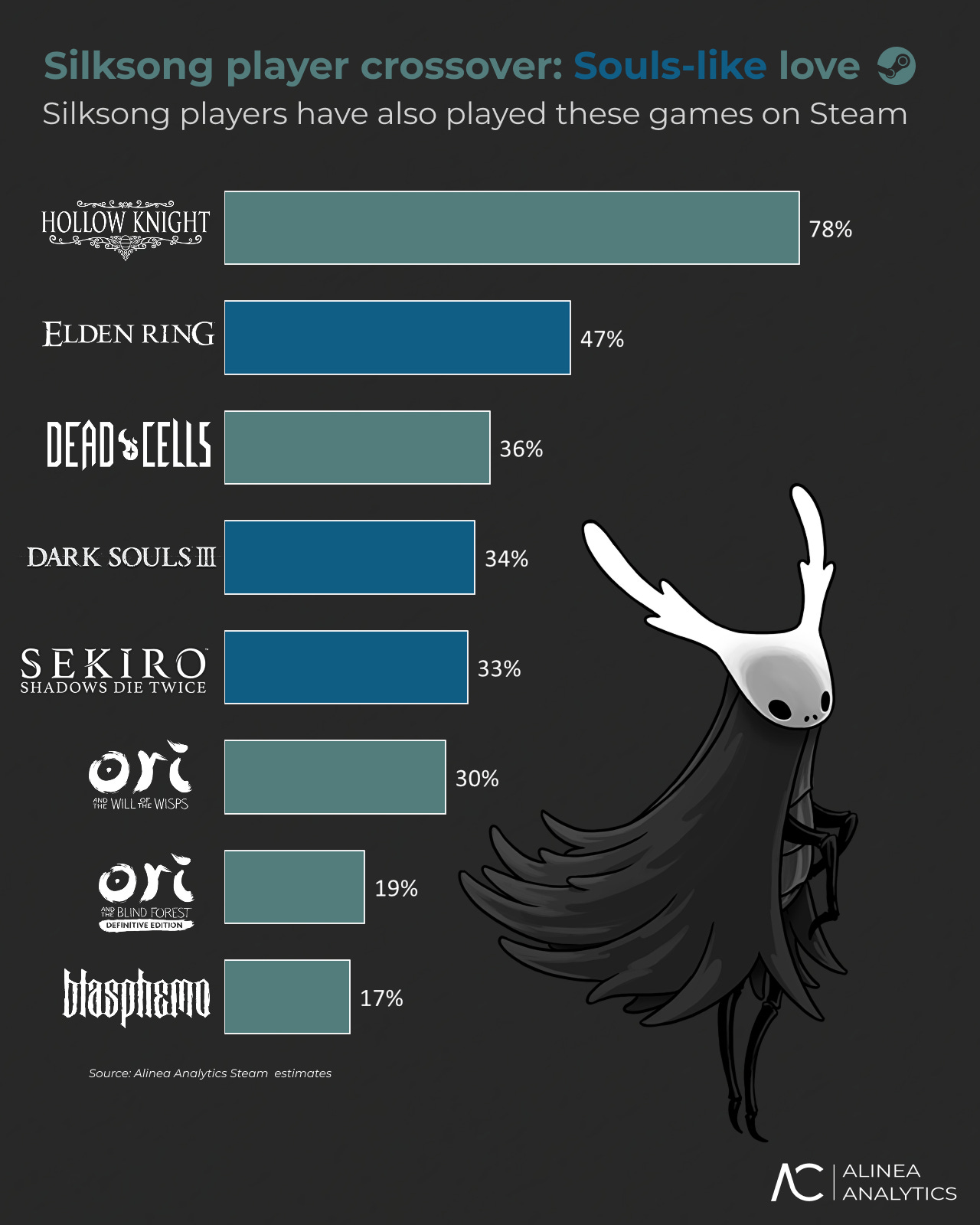

What Silksong players play

Silksong’s audience so far is loyal to the Metroidvania genre, but it’s also broader than many realise.

On Steam, 78% of Silksong players own the original Hollow Knight (81% on PlayStation), which isn’t surprising.

But almost half of Silksong’s players on Steam also played Elden Ring on the platform, while over a third have played Dark Souls 3 and also Sekiro. Good thing, really, because Silksong is closer to those than it is to Dead Cells and Ori, in my opinion.

Smashing my head against quite a few Silksong bosses (I’m looking at you, Savage Beastfly ) felt more like a Souls game than a leisurely platforming romp in Ori’s gorgeous worlds or the RNG goodness of Dead Cells.

As you can see below, Silksong’s audience has just as much overlap with souls-likes as it does with other Metroidvanias. More, in many cases.

Fans of punishing, atmospheric, carefully crafted worlds show up across these games, and Silksong is capturing them. And it will continue to do so as word continues to get out about Silksong’s often-brutal difficulty.

So, focusing too narrowly on one genre (Metroidvanias, in this case) or budgets (indie releases) risks missing the bigger picture. Silksong is proof that core gamers sometimes think in terms of experiences and mechanics, not in marketing categories.

Want help sifting through that stuff? Hit subscribe for free below to get an analysis of the world’s most accurate game estimates twice a week.

A singular indie launch

There was also a lot of chatter online about Silksong being overhyped, and that other indies this year had done just as well as Silksong would.

Whoops.

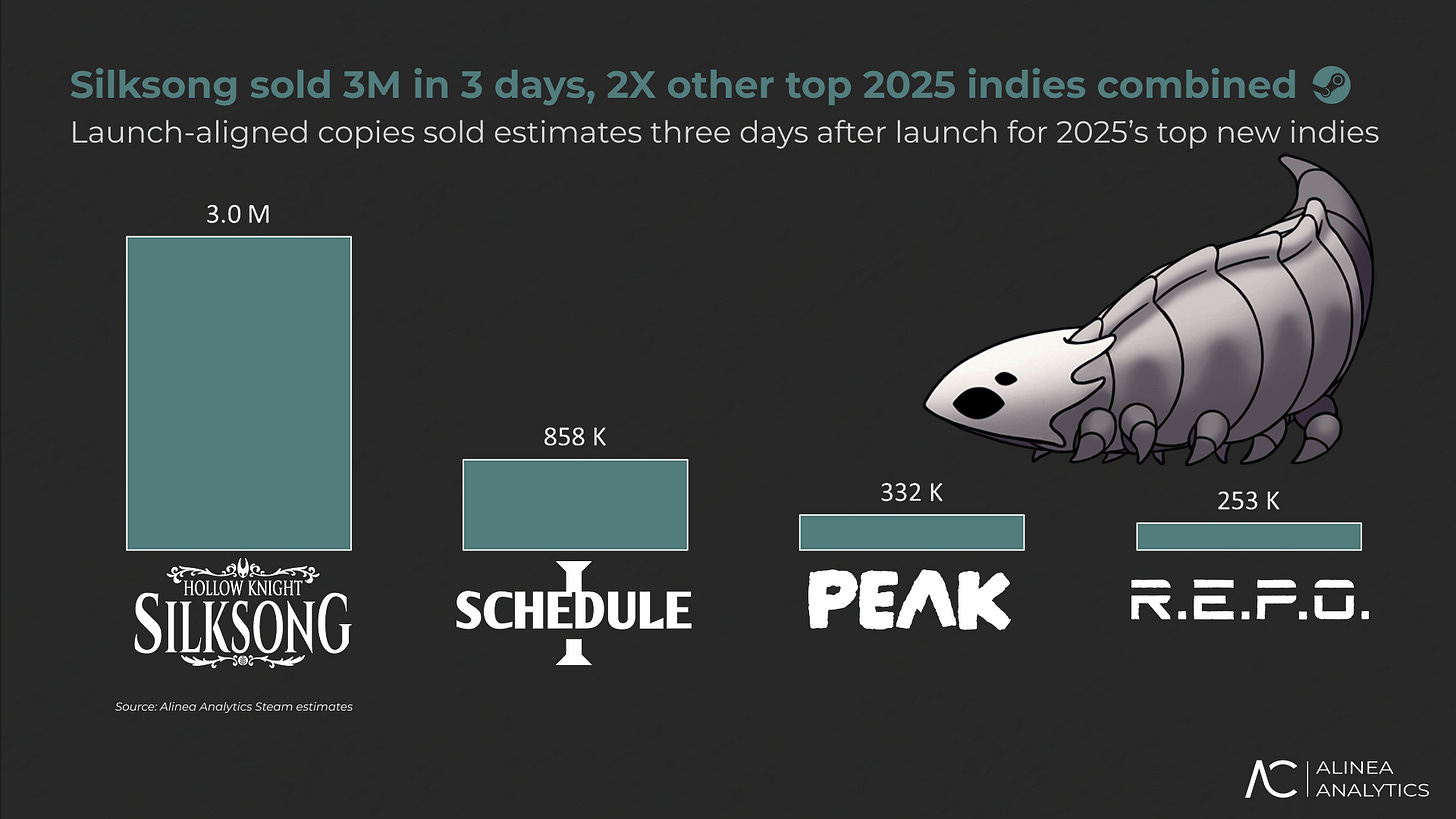

To put Silksong’s launch in perspective, here’s how its three-day Steam sales stack up against 2025’s biggest indie hits:

After three days on the market, Silksong outsold its closest 2025 indie competitor by more than 3.5x in the same timeframe. And it sold double the #2, #3, and #4 games combined (launch-aligned in three days).

That said, Schedule I, PEAK, and R.E.P.O. were viral successes that blew up gradually, while Silksong had that pent-up demand. So stay tuned for more updates on Silksong’s post-launch tail.

Silksong is the kind of breakout that puts this tiny studio on the same radar as mid-sized publishers. And there was a smart strategy that helped a little towards Silksong hitting $5 million in Steam revenues so quickly. Every little helps.

A bundle of musical joy

Silksong costs just $20, which is music to the ears of many players. And speaking of music, Team Cherry offers a more expensive version of the game bundled with its wonderful soundtrack.

This is a smart move for a few reasons:

It lets players support a studio they love: Hollow Knight has one of the most dedicated fanbases in indie games, and many of them were going to buy Silksong day one regardless, especially at twenty bucks. By offering a bundle, Team Cherry gave fans a way to spend more without feeling squeezed. The soundtrack is a tangible, desirable extra, not a meaningless upsell. It’s entirely optional for superfans, unlike those early-access collector’s editions.

It strengthens the brand: Christopher Larkin’s music was one of the most beloved parts of Hollow Knight (and that’s saying something). Silksong’s score is arguably even better. Packaging it with the game reinforces that the music is not just background noise, but a core part of the Hollow Knight experience.

It’s efficient in terms of monetisation: Soundtracks are high-margin digital products. They can be sold infinitely with virtually no added cost. Every extra dollar from a bundle is almost pure profit, Steam’s cut aside.

It’s a small move with a deeper impact. Bundling like this doesn’t alter the overall scale of Silksong’s financial success, but it demonstrates that Team Cherry understands how to convert player enthusiasm into sustainable revenue – without compromising trust or feeling icky.

What’s next for Silksong?

The question now isn’t whether Silksong will sell, but how far it can go. The momentum is undeniable, the fanbase is engaged at a near-religious level (all hail the Hornet), and the global footprint is wide.

If Silksong follows anything like the legs of Hollow Knight, which has sold steadily for years, Team Cherry could be staring down one of the best-selling indies of all time.

We’ll be tracking it closely, because this is no ordinary launch. This is the kind of game that rewrites what’s possible for its genre.

We’ll be checking in on Silksong again next week. So hit subscribe below to get that data right in your inbox.

Back to Pharloom for me, then.

The last word

Reply to this email – or reach out here – if you have any feedback for the newsletter – or want to request a game for us to cover.

[Alinea Analytics boasts the most accurate PC and console estimates in the business. Game makers use our platform to understand their audience, keep an eye on the competition, monitor sales trends, and spot new opportunities. We equip game studios and financial institutions with accurate data and the confidence to make smarter, data-driven decisions. Want to talk about all things game market data? We’d love to chat!]

It's worth noting, Silksong, unlike the first game, have adjusted regional pricing for Poland:

Hollow Knight: Silksong

EU: 19.50€ (82,88 zł),

PL: 74,99 zł (-7,89 zł, -9,53%)

Steam recommended price: 91,99 zł

The first game:

Hollow Knight

EU: 14.79 € (62,86 zł),

PL: 67,99 zł (+5,13 zł, +8,16%)

Steam recommended price: 67,99 zł

That's thanks to the community effort to make the developers aware of the issue - that Steam regional pricing wasn't updated since 2022: https://www.reddit.com/r/pcgaming/comments/1llwzls/steam_automatic_regional_pricing_is_outdated_last/

https://polishourprices.pl/for_publishers

There were multiple posts on social media and Steam forums:

https://x.com/PolishOurPrices/status/1960643580046832008

https://x.com/PolishOurPrices/status/1962432221073047911

https://bsky.app/profile/kondiq.bsky.social/post/3lxrc7gkg2s27

https://x.com/Kondiq/status/1962448779216355372

https://steamcommunity.com/app/1030300/discussions/0/595158831570488283/

Team Cherry didn't respond, but they adjusted the price.

Not long ago, the same thing happened in case of Palworld, but the developers posted an announcement that they heard players from Poland and adjusted the price:

https://bsky.app/profile/en-palworld.pocketpair.jp/post/3lvyckphkck2b

https://x.com/Palworld_EN/status/1954233801657471203

https://steamcommunity.com/games/1623730/announcements/detail/518595390150279687

All links to the Polish Our Prices (the community which informs developers and publishers about the need to adjust the prices for Poland) social media and Steam curators are here:

https://linktr.ee/PolishOurPrices